Vehicle excise duty

The amount depends on the energy efficiency of each vehicle and it can be up to 1000 per year. Web Delaware State Police Investigating Fatal Collision on I-95.

101 Vehicle Excise Duty Images Stock Photos Vectors Shutterstock

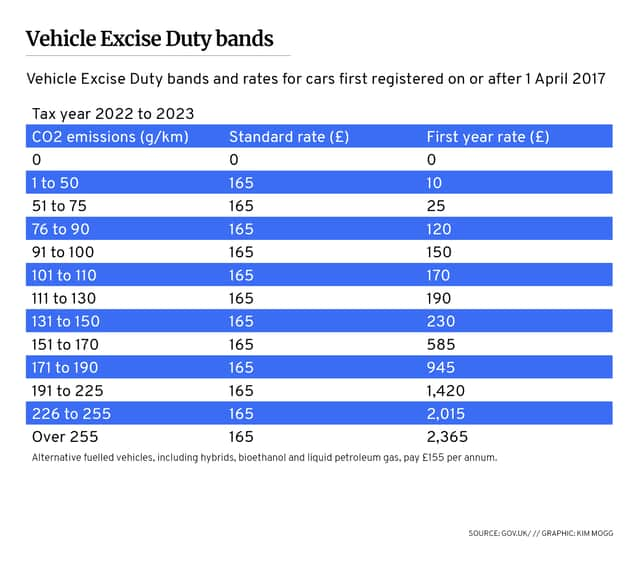

Web This measure reforms Vehicle Excise Duty VED for cars first registered from 1 April 2017 onwards.

. Web 15 hours agoIf the car was registered before 1 March 2001 the excise duty is based on engine size - 180 for vehicles with a capacity of less than 1549cc and 295 for vehicles with bigger engines. Web 15 hours agoThe government has put new taxes on electric vehicles as it tries to plug a hole in the countrys finances. Not just mailed postmarked on or before the due date.

In the early 20th century it was ring-fenced as part of a road fund which was intended to improve and maintain roads. You are personally liable for the excise until the it is paid off. The road-tax rate a driver will pay varies based on the cars age and CO2 emissions.

Delaware State Police are investigating a fatal motor vehicle collision that occurred on Interstate 95 in the Newark area early this morning. Private or light goods TC11 engine size 1549 cc and under. For cars registered from April 2017 onwards first-year VED.

Web 15 hours agoVehicle Excise Duty VED also known as road tax or car tax is paid by every vehicle on UK roads. Web Motorhomes registered between 1 April 2017 and 11 March 2020 will pay a different rate of tax based on the M1SP category. We think the likely answer to this clue is ROAD TAX.

Below are all possible answers to this clue ordered by its rank. Web The Town mails motor vehicle excise bills to registered owners once a year or after a change in registration. On November 11 2022 at approximately 1243 am.

Web Electric vehicles EVs will no longer be exempt from vehicle excise duty VED from April 2025. Single 12 month payment. VED is a tax applied on every vehicle with the.

Drivers pay road tax when they first register their car and then again either every six or 12 months. Web Electric vehicles will no longer be exempt from vehicle excise duty VED from April 2025 as part of key policy changes in the autumn statement. In 1920 an excise duty was introduced that was specifically applied to motor vehicles.

Jeremy Hunt confirmed green cars will no longer be exempt from paying road taxes from. VED is also commonly referred to as car tax and does. Sign Up new users.

If an excise bill remains unpaid for 14 days after the issuance of the demand the tax collector. However VED as we know it now was introduced in 1936 and was no longer ring-fenced with all proceeds going to the. Private or light goods TC11 engine size 1550 cc and over.

Chancellor Jeremy Hunt announced that he wanted to make motoring taxes fairer as he revealed. If the vehicle has been recently purchased the 6 excise tax is based on the greater of the total purchase price verified by a notarized M VA Bill of Sale form VR-181 signed by both the buyers and the sellers in which the actual price paid for the vehicle is stated or 640. VACANT POSITIONS CLICK Project Excise Taxation Narcotics Control Department Government of Sindh under World bank.

For most cars registered prior to April 2017 the amount of VED due depended primarily on the cars official CO 2 emissions. Electric vehicles will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said. Announcing the change as part.

First Year Rates FYRs of VED will vary according to the carbon dioxide CO2 emissions of. The tax collector must have received the payment. Web Vehicle excise duty VED is a tax levied on every vehicle using public roads in the UK and is collected by the Driver and Vehicle Licensing Agency DVLA.

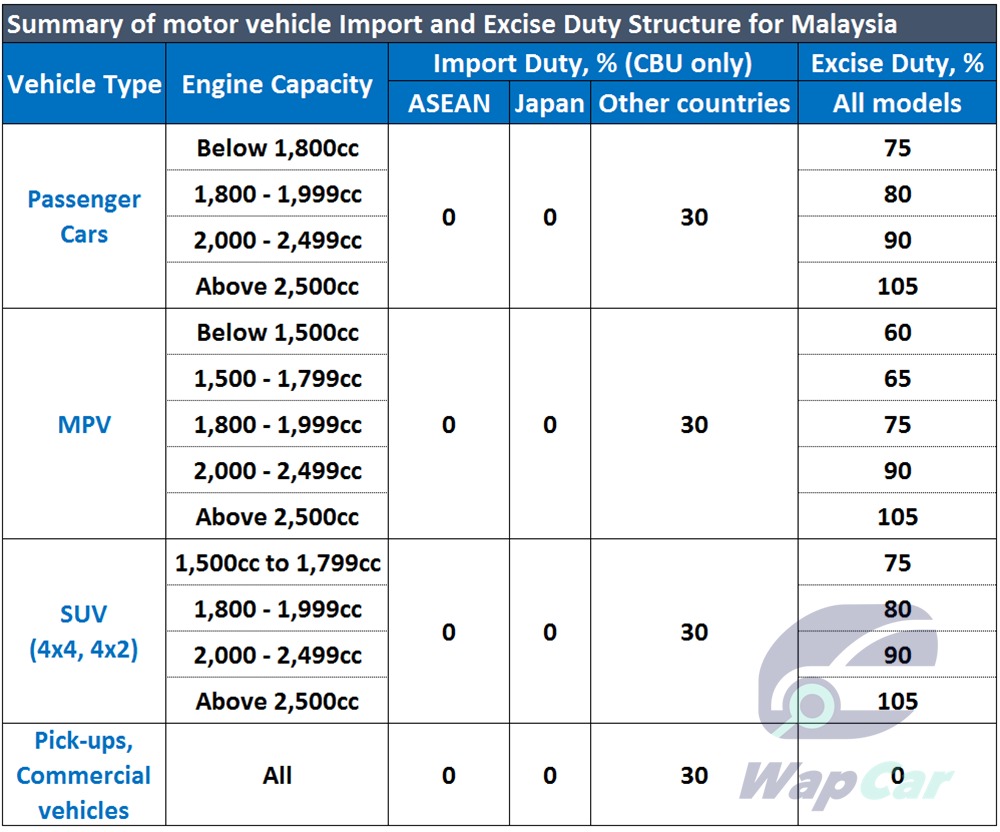

Note that a CIF Value of US6000 was used for a vehicle 2800 cc. Web 15 hours agoElectric vehicle drivers to pay car tax from April 2025. B accepts transfer outside the state and fails to apply for a certificate of title within 90 days of bringing the vehicle.

After 30 days a demand notice will be mailed adding a 15 fee plus interest. Web Motor Vehicle Tax Property Tax Entertainment Duty Excise Duty Cotton Fee Infrastructure Cess Professional Tax. Web A vehicle tax was first introduced in Britain in 1888.

Payments are due 30 days from the date of issue of the bill. LOG IN optional Logging in will give you access to eBilling AutoPay bill history and other features. Web A penalty of 50 of the Motor Vehicle Excise Tax is imposed on any person who lives in New Mexico and either.

Web Vehicle Excise Duty. Vehicles under four years old Diesel and Semi Diesel. Details published by the Treasury reveal that EV drivers will pay 165 a year for cars registered between April 1.

Convenience Fees May Apply. Initially it was hypothecated ring-fenced or earmarked for road construction and paid directly into a special Road Fund. Credit and Debit Cards.

Web Duty 45 of CIF Excise 110 of Duty CIF VAT 14 CIF Duty Excise Tax Total Tax Payable Customs Duty Excise Tax VAT Example. A accepts transfer of a vehicle in New Mexico but fails to apply for a certificate of title within 90 days or. Log In Sign Up.

The crossword clue Vehicle excise duty with 8 letters was last seen on the February 07 2022. Private heavy goods TC10 165. Web A motor vehicle excise is due 30 days from the day its issued.

Web 15 hours agoElectric car owners will have to pay Vehicle Excise Duty VED from April 2025. There is no statute of limitations for motor vehicle excise bills. Web This measure reforms Vehicle Excise Duty VED for cars registered from 1 April 2017 onwards.

First Year Rates of VED will vary according to the carbon dioxide CO2 emissions of the vehicle. Friday November 11th 2022. Web Vehicle tax first came about in 1888 and was payable by all motor vehiclesnot just cars.

Web 10 hours agoVehicle Excise Duty is better known as road tax. Web Maryland Excise Titling Tax. You can easily improve your search by specifying the number of letters in the answer.

Drivers of vehicles that cost more than 40000 will have to pay an additional fee dubbed the Tesla Tax. In other cases the total purchase. Web 14 hours agoChancellor scraps Vehicle Excise Duty exemption for EVs from 2025 Jeremy Hunt says decision will make road taxation system fairer Industry bodies criticise unhelpful decision Hunt also confirms change to top rate of income tax Car dealers earning more than 125140 will now pay 45p rate.

Excise 110 6000 2700 9570. Web Vehicle excise duty VED refers to the tax which must be paid for most vehicles in the UK that are either driven or parked on public roads.

Vehicle Licensing And Tax Ved Commercial Motor

Vehicle Excise Duty Ved Greencarguide Co Uk

How Much Road Tax Will I Pay After April 2022 Carparison

Vehicle Excise Duty Reform Raises More Questions Than Answers

The Excise Duty Changes In Poland In 2019 Vgd

Road Tax Rule Changes What Do They Mean

Bvrla Vehicle Excise Duty Ved

Q A Vehicle Excise Duty Changes Transport Policy The Guardian

How Do I Tax My Car Moneysupermarket

2023 Van Tax Guide How Taxing A Van Works

Car Tax Bills To Rise By Up To 65 A Year From Next Month Due To Vehicle And Excise Duty Hike The Sun

Vehicle Excise Duty Small Car Buyers Face Higher Costs Bbc News

Car Vehicle Excise Duty Kia Cee D Car Insurance Vehicle Transport Png Pngwing

Tchtis Tniutkm

Opinion Time To Scrap Vehicle Excise Duty

This Is How Much Drivers Will Pay In Car Taxes From 1 April Nationalworld

Ved Tax Changes 2021 Autotrader